When investors want regular income from their investments the automatic choices for many are bank term deposits or post office monthly income scheme. However, declining interest rates have caused many investors to be worried about meeting their income needs from traditional savings schemes. Dividend is another source of income for some investors, but you should understand that dividends are distributed from the profit after tax of a company. If a company makes a loss, for any reason, it will not be able to pay dividends. Further, dividends are declared at the discretion of the management; so there is no assurance of the dividend amount for the shareholder. Most importantly, retail investors should remember that investing in shares of companies can be quite risky, unless you have sufficient experience and expertise in equity investing.

Based on the investor queries received by Advisorkhoj.com and traffic analytics of different sections of our website, we have seen that lot of investors are now interested in mutual fund schemes which pay regular dividends. Mutual funds are less risky than stocks since company specific risks are diversified away in mutual funds and as such, they are better investment options for retail investors. Some mutual fund schemes have excellent dividend pay-out track records and as such, can be good investment options for investors seeking regular income.

However, it is important for mutual fund investors to know that, regulations decree dividends to be paid only from the accumulated profits of a scheme. Mutual funds are subject to market risks and their performance is linked to market conditions. If a mutual fund scheme is not able to make profits due to adverse market conditions it will not be able to pay dividends. Dividends are declared at the discretion of the fund manager of the scheme and there is no assurance with respect to amount or timing of the dividend.

Investors, who want to meet all or most of their income needs from their investments, require a fair bit of certainty with respect to cash-flows, both in terms of amount and timing. Systematic Withdrawal Plans is a smart investment option for such investors because it gives fixed cash-flows to investors. We are seeing lot of interest in Systematic Withdrawal Plans among retail investors; it shows growing maturity of Indian investors and willingness to explore non-traditional investment options.

What is Systematic Withdrawal Plan?

In Systematic Withdrawal Plan (SWP), you can draw a fixed amount from your mutual fund investment at a specified frequency (monthly, quarterly, annual etc.); you can specify the day of the month when the withdrawal should be made and the amount will be credited directly to your bank account on the specified day. You can continue your SWP as long as there are balance units in your mutual fund scheme account.

To know more about SWP.

How does Systematic Withdrawal Plan work?

Systematic Withdrawal Plan generates cash-flows (income) for investors by redeeming units of mutual fund scheme at specified intervals. The number of units redeemed to generate cash-flows in an SWP depends on the SWP amount and the scheme Net Asset Values (NAV) on the withdrawal dates. For example, let us assume you invested Rs 10 lakhs in a mutual fund scheme. The purchase NAV was Rs 20; so, 50,000 units will be allotted to you. Let us assume you start a monthly SWP of Rs 6,000 after one year from the date of investment to avoid exit loads. In the first month of the SWP, the scheme NAV is 25 (illustrative). In order to generate Rs 6,000 for you, the Asset Management Company (AMC) will redeem 240 units (Rs 6,000 divided by 25). Your balance units will be 49,760 (50,000 minus 240). In the second month, if the NAV is 27, the AMC will redeem 222.22 units ((Rs 6,000 divided by 25) for the SWP and your unit balance will be 49,537.78 (49,760 minus 222.22). In the third month if the scheme NAV is 28, the AMC will redeem 214.28 units and your unit balance will be 49,323.49.

In an SWP, your unit balance will diminish over time, but if the NAV keeps moving at a faster rate than your withdrawal rate, then your investment value will be higher. In the above example, after your third SWP instalment, your investment value will be Rs 13,81,058. You can see that, your investment value has gone up even after making monthly withdrawals. However, if the scheme NAV keeps falling instead of rising, like in a bear market, then effect on your investment value will be opposite, because withdrawals in a falling NAV scenario will require redemption of a higher number of units. Consequently, you will be left with a lower unit balance, which in an environment of falling NAVs can have an adverse impact on your investment.

You may like to know.

An actual SWP example

In stock market, we have both periods of both rising market and falling market. Let us see how SWP works over a sufficiently long period of time, covering both bull and bear markets. In the example below, we will see the results of a monthly SWP from SBI Bluechip Fund over the last 5 years. The last 5 years had both bull and bear markets. Let us assume you invested Rs 10 lakhs in SBI Bluechip Fund (Growth Option) on August 1, 2008.

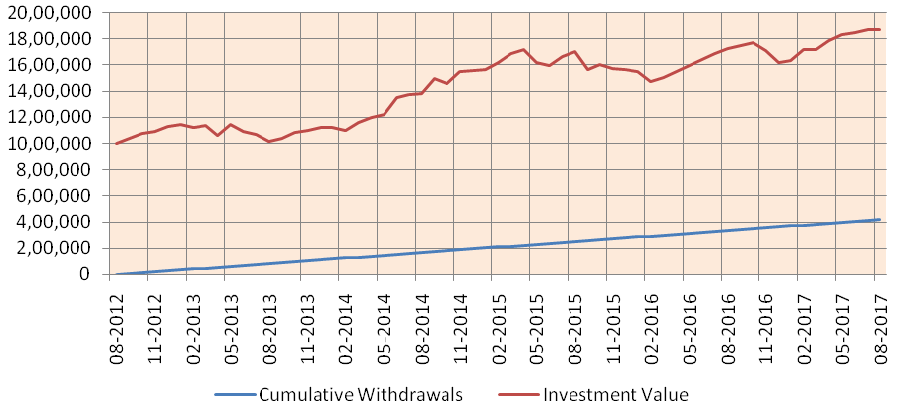

Further, let us assume that your SWP amount is Rs 7,000 and that your withdrawal date is the 10th of every month. In Advisorkhoj,we urge you to use our calculator, if you are planning an SWP, to get a sense of historical SWP performance of different schemes. We will present the results of the SBI Bluechip Fund SWP example in a summary format; to see detailed results.

You can see that, despite making regular withdrawals (cumulative withdrawal of Rs 4.2 lakhs in the last 5 years), the current investment value (as on August 18, 2017) is over Rs 18.7 lakhs. The SWP return (XIRR) is over 20.6%.

How did we get such impressive results?

The impressive results can be attributed to two main factors. Firstly, the scheme performance was great over the last 5 years. The importance of selecting a good scheme, which gives consistently good returns, cannot be understated. Consistency of performance is extremely important when you are selecting funds for SWP because you will be making regular withdrawals in SWP. A scheme which underperforms for long periods of time can undermine your SWP; hence, the importance of consistent performance in SWP.

The second important factor was that, our withdrawal rate was not excessively high. Your withdrawal rate will be determined by your cash-flow needs, but if it is higher than the average rate of return on investment over a certain period, then you may end up with less than what you invested.

In fact, in our view, you should adopt a conservative approach to withdrawal, because capital markets can be unpredictable. If there is a market crash just when you are beginning your SWP, you will see your unit balance diminishing rapidly. When planning an SWP, it always prudent to be prepared for a bear market (where market can crash 20 – 30%). If the market crashes 30% and your withdrawal rate is 20% per annum, your investment value will be 50% of your initial investment amount; it can take a long time to recover from such a situation. On the other hand, if you withdrawal rate is lower, the recovery will be that much faster.

What should be the ideal withdrawal rate?

There are no hard and fast rules. There is one school of thought, which says that, you withdraw what you need. If your investment amount is large enough to ensure that your withdrawal rate is lower than the average return on investment, over a period of time, it is fine. There is another school of thought, which advocates a more conservative approach, allowing for the possibility of a bear market before your investment has a chance to grow in value.

There is a third school of thought, which recommends the withdrawal rate to be the same as or lower than long term fixed income returns (Government Bond average long term yields can be taken as a proxy for long term fixed income returns). We used the third approach, in the SBI Bluechip Fund SWP example, but we are not saying that, this is the ideal approach. Your withdrawal rate should be determined by how much you can invest, your cash-flow needs, and at same time, making sure that, the withdrawal rate is lower than the average rate of return over a period of time, allowing for the possibility of a bear market in the near future. It is a careful balancing act.

Be mindful of exit loads and capital gains tax considerations

SWP is essentially a series of redemptions, to meet your income needs. Mutual fund unit redemptions, within a certain period from the date of investment, may attract exit loads. Therefore, you should be consider exit load period when planning your SWP. You should also know that, capital gains tax will apply, when you are selling your mutual fund units within 12 months from the date of investment. Profits made from sale of units of equity funds within 12 months from the date of investment are taxed at 15% (short term capital gains tax). Profits made from sale of units of equity funds after 12 months from the date of investment are tax-free. You should plan your SWP accordingly.

Long term SWP from debt oriented funds can yield tax benefits compared to traditional products

Interest income from traditional fixed income products like bank FDs (term deposits) and post office savings schemes are taxed as per the income tax slab of the investor. Debt mutual fund dividends, though tax-free in hands of the investors, attract a dividend distribution tax of 28.84%, payable by the AMC, thereby reducing the actual dividend pay-out to investors. Long term capital gains tax from debt funds are taxed at 20% after allowing for indexation benefits.

SWPs over a long term from debt funds result in the incidence of long term capital gains tax after 3 years from the date of investment. SWPs are therefore, more tax efficient than traditional fixed income schemes or even dividend options of debt funds, over a long (more than 3 years) investment horizon.

SWP from balanced funds is also an ideal option as the taxation of balanced funds is same as that of equity funds

Conclusion

Mutual funds offer a variety of smart and convenient options to meet specific needs of investors. While awareness of mutual funds in India has been increasing steadily over the past decade, there is still lack of awareness of some smart investment facilities available to investors. Our endeavour is to enhance awareness of the smart facilities among the investor population. In this blog post, we discussed about various aspects of Systematic Withdrawal Plans. SWP is a smart and convenient option for getting predictable cash-flows from your investment; at the same time, there a multiple considerations that you need to be aware of, to get the desired results from your SWP. If you need regular income from your investments, you should discuss Systematic Withdrawal Plan options with your financial advisors..

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

No comments:

Post a Comment