by Dwaipayan Bose

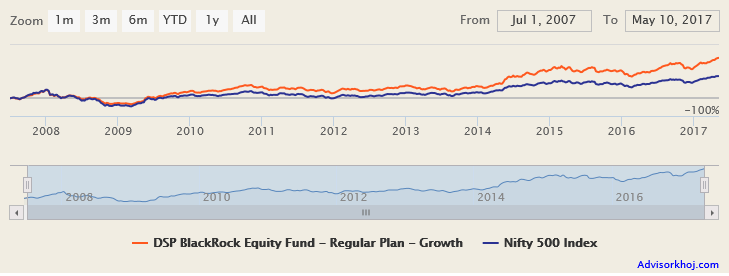

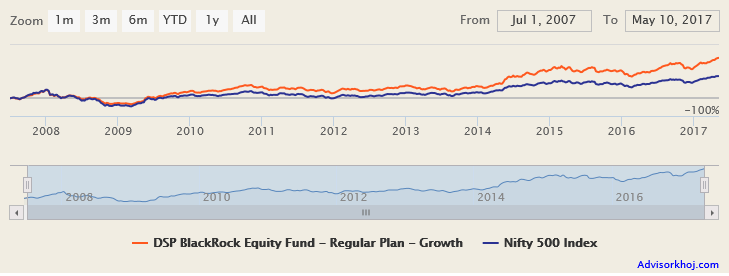

An investment of Rs 1 lakh in DSP BlackRock Equity Fund New Fund Offer (NFO), 20 years back, would have grown to around Rs 44 lakhs today. The return of this diversified equity mutual fund scheme since inception is a great example of the wealth creation potential of equity funds over a long investment horizon. DSP BlackRock Equity Fund was launched in April 1997 and has nearly Rs 2,400 Crores of assets under management (AUM). The expense ratio of the fund is 2.4%. The fund has given nearly 21% annualized returns since inception. The chart below shows the NAV movement of this fund over the past 10 years.

Though the fund performance has been a bit consistent over the past 5 years or so, we have noticed a turnaround in 2016 (notice the divergence between the fund returns and the benchmark, Nifty 500 index returns over the past 2 years or so in the chart above), when the fund fought its way back into the upper performance quartiles of the diversified equity fund category. The improvement trend has been sustained in 2017 so far and DSP BlackRock Equity Fund is a top quartile fund on a year to date basis. In the last 12 months the fund has given nearly 33% returns. Atul Bhole is the fund manager of this scheme.

Rolling Returns

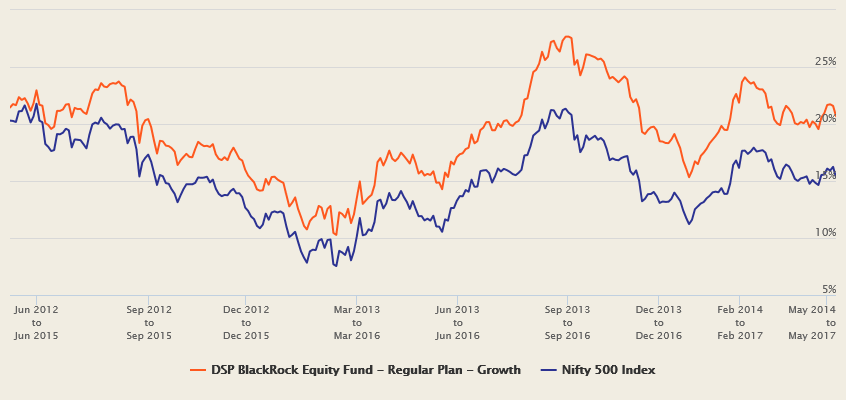

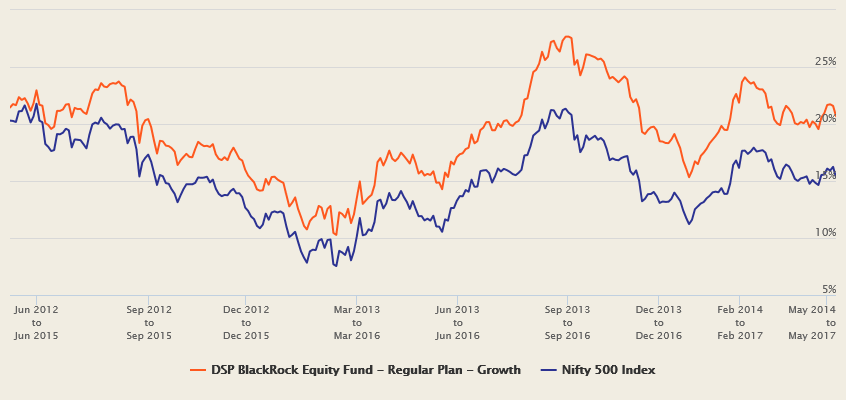

The chart below shows the 3 year rolling returns of DSP BlackRock Equity Fund over the past 5 years. We chose a 3 year rolling returns period because we think that, equity investors should have at least a three year investment period, if not more; the longer, the better.

You can see that, DSP BlackRock Equity Fund consistently outperformed the Nifty 500 index in terms of 3 years rolling returns over the past 5 years. The quantum of outperformance has improved over the past 2 years or so (as you can in the chart above). The fund gave more than 15% annualized 3 year rolling returns nearly 90% of the times over the past 5 years. The highest 3 year rolling returns over the past 5 years was 27.5% while the lowest was 10.5%.

Investment Style and Portfolio Construction

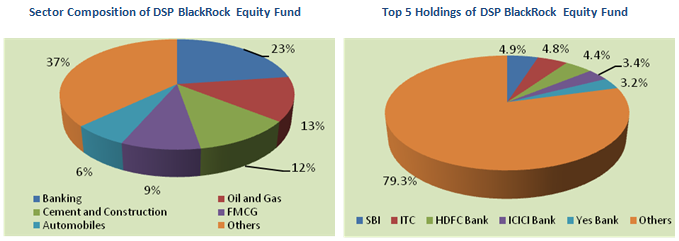

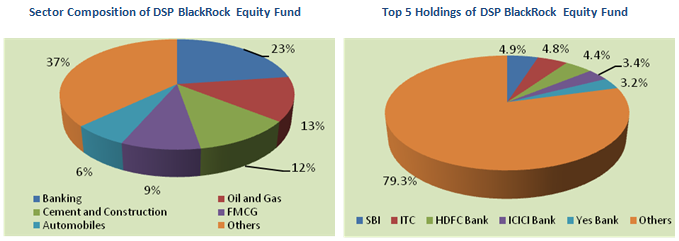

DSP BlackRock as a fund house traditionally favoured value style of investment, but over the past year or so, they have shifted their focus to earnings (EPS) growth and relative valuations. This worked well for DSP BlackRock. DSP BlackRock Equity Fund’s fund manager employs a blend of growth and value styles of investing. From a sector perspective, DSP BlackRock Equity Fund is heavily biased towards sectors focused on domestic consumption. Banks, Oil and Gas, Cement and Construction, Automobiles, Fast Moving Consumer Goods (FMCG) and Capital Goods form a major part of the scheme’s portfolio. Exposure to troubled export oriented sectors like Technology and Pharmaceuticals is quite limited. From a market capitalization standpoint, the fund is large cap oriented with large cap stocks accounting for nearly 65% of the portfolio, while midcap and small cap stocks account for the remaining portion. The fund is very well diversified from a company concentration viewpoint, with the Top 5 stocks, State Bank of India, ITC, HDFC Bank, ICICI Bank and Yes Bank accounting for only 21% of the portfolio value.

SIP Returns

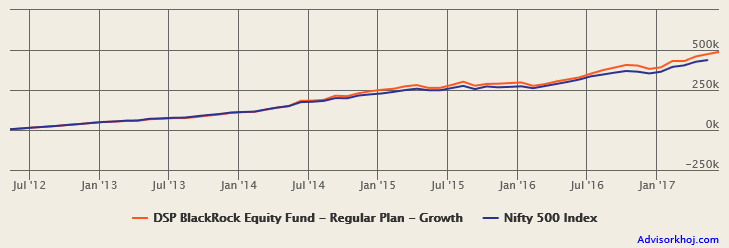

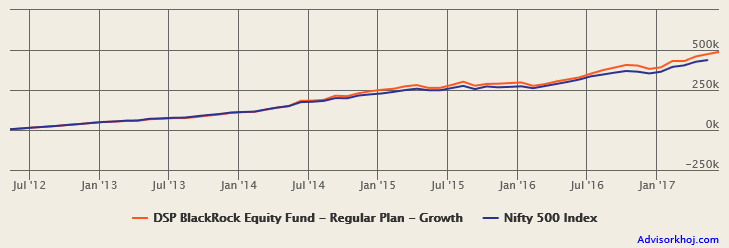

The chart below shows the growth of Rs 5,000 monthly SIP in DSP BlackRock Equity Fund (Growth Option) over the last 5 years.

With a cumulative investment of just Rs 3.05 lakhs (through monthly SIP of Rs 5,000) you could have accumulated a corpus of Rs 4.88 lakhs; a profit of Rs 1.83 lakhs in 5 years. The annualized SIP returns (XIRR) is over 19%.

Conclusion

DSP BlackRock Equity Fund, which recently completed 20 years, has historically been a top performing diversified equity fund. Though the fund performance was subdued for a period of time, the strong outperformance versus the benchmark and its peers since 2016 is quite encouraging. The pedigree of this fund is evident from the wealth creation by this fund over the last 20 years. As a fund house, DSP BlackRock is one of the most respected Asset Management Companies in India, with several top performing mutual fund schemes across several categories in its product portfolio. Investors should have a long term investment horizon for DSP BlackRock Equity Fund. You can invest in this fund from your regular savings through SIP for long term capital appreciation. You can also take advantage of market dips to invest in this fund in lump sum. Investors should consult with their financial advisors if DSP BlackRock Equity Fund is suitable for their long term investment goals. (Courtecy: Advisors Khoj)

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

An investment of Rs 1 lakh in DSP BlackRock Equity Fund New Fund Offer (NFO), 20 years back, would have grown to around Rs 44 lakhs today. The return of this diversified equity mutual fund scheme since inception is a great example of the wealth creation potential of equity funds over a long investment horizon. DSP BlackRock Equity Fund was launched in April 1997 and has nearly Rs 2,400 Crores of assets under management (AUM). The expense ratio of the fund is 2.4%. The fund has given nearly 21% annualized returns since inception. The chart below shows the NAV movement of this fund over the past 10 years.

Though the fund performance has been a bit consistent over the past 5 years or so, we have noticed a turnaround in 2016 (notice the divergence between the fund returns and the benchmark, Nifty 500 index returns over the past 2 years or so in the chart above), when the fund fought its way back into the upper performance quartiles of the diversified equity fund category. The improvement trend has been sustained in 2017 so far and DSP BlackRock Equity Fund is a top quartile fund on a year to date basis. In the last 12 months the fund has given nearly 33% returns. Atul Bhole is the fund manager of this scheme.

Rolling Returns

The chart below shows the 3 year rolling returns of DSP BlackRock Equity Fund over the past 5 years. We chose a 3 year rolling returns period because we think that, equity investors should have at least a three year investment period, if not more; the longer, the better.

You can see that, DSP BlackRock Equity Fund consistently outperformed the Nifty 500 index in terms of 3 years rolling returns over the past 5 years. The quantum of outperformance has improved over the past 2 years or so (as you can in the chart above). The fund gave more than 15% annualized 3 year rolling returns nearly 90% of the times over the past 5 years. The highest 3 year rolling returns over the past 5 years was 27.5% while the lowest was 10.5%.

Investment Style and Portfolio Construction

DSP BlackRock as a fund house traditionally favoured value style of investment, but over the past year or so, they have shifted their focus to earnings (EPS) growth and relative valuations. This worked well for DSP BlackRock. DSP BlackRock Equity Fund’s fund manager employs a blend of growth and value styles of investing. From a sector perspective, DSP BlackRock Equity Fund is heavily biased towards sectors focused on domestic consumption. Banks, Oil and Gas, Cement and Construction, Automobiles, Fast Moving Consumer Goods (FMCG) and Capital Goods form a major part of the scheme’s portfolio. Exposure to troubled export oriented sectors like Technology and Pharmaceuticals is quite limited. From a market capitalization standpoint, the fund is large cap oriented with large cap stocks accounting for nearly 65% of the portfolio, while midcap and small cap stocks account for the remaining portion. The fund is very well diversified from a company concentration viewpoint, with the Top 5 stocks, State Bank of India, ITC, HDFC Bank, ICICI Bank and Yes Bank accounting for only 21% of the portfolio value.

SIP Returns

The chart below shows the growth of Rs 5,000 monthly SIP in DSP BlackRock Equity Fund (Growth Option) over the last 5 years.

With a cumulative investment of just Rs 3.05 lakhs (through monthly SIP of Rs 5,000) you could have accumulated a corpus of Rs 4.88 lakhs; a profit of Rs 1.83 lakhs in 5 years. The annualized SIP returns (XIRR) is over 19%.

Conclusion

DSP BlackRock Equity Fund, which recently completed 20 years, has historically been a top performing diversified equity fund. Though the fund performance was subdued for a period of time, the strong outperformance versus the benchmark and its peers since 2016 is quite encouraging. The pedigree of this fund is evident from the wealth creation by this fund over the last 20 years. As a fund house, DSP BlackRock is one of the most respected Asset Management Companies in India, with several top performing mutual fund schemes across several categories in its product portfolio. Investors should have a long term investment horizon for DSP BlackRock Equity Fund. You can invest in this fund from your regular savings through SIP for long term capital appreciation. You can also take advantage of market dips to invest in this fund in lump sum. Investors should consult with their financial advisors if DSP BlackRock Equity Fund is suitable for their long term investment goals. (Courtecy: Advisors Khoj)

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

No comments:

Post a Comment